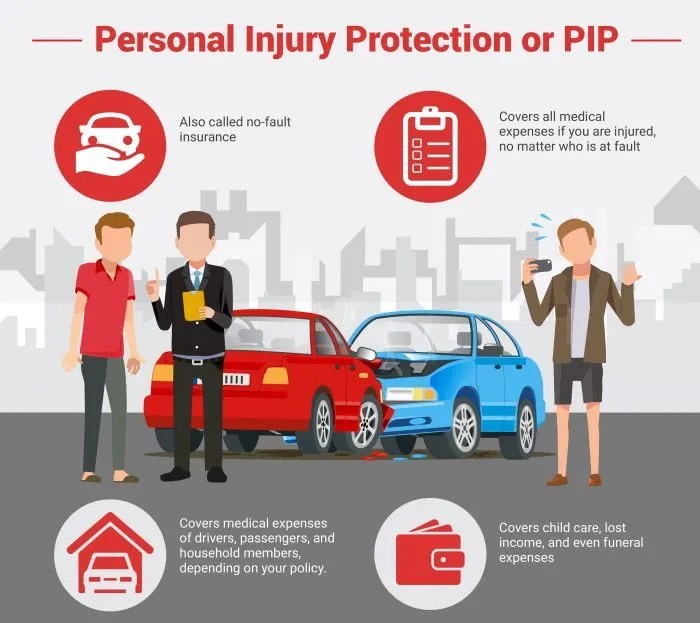

When you’re involved in a car accident, Personal Injury Protection (PIP) can play a critical role in covering your medical bills, lost wages, and other expenses. Often called “no-fault insurance,” PIP is designed to provide swift, accessible compensation to policyholders, regardless of who is at fault. This guide will delve into what PIP insurance entails, how to file a PIP claim, and tips for maximizing your benefits.

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of insurance that covers medical expenses, lost wages, and other costs that may arise from injuries sustained in a car accident. PIP is required in no-fault states, meaning that it pays out regardless of who caused the accident. This differs from liability insurance, which only covers injuries to others if you’re at fault.

PIP vs. Medical Payments Coverage (MedPay)

Though similar to MedPay, which covers medical bills after an accident, PIP generally offers more extensive benefits. While MedPay only covers immediate medical expenses, PIP can cover a broader range of expenses, including rehabilitation costs, lost wages, and even household services needed during recovery.

Coverage and Benefits of PIP

Understanding what PIP insurance covers is essential to ensure you’re fully compensated for injuries and other related expenses after an accident. Here are the primary benefits provided by PIP:

| PIP Coverage | Description |

|---|---|

| Medical Expenses | Covers medical bills, including surgeries, hospital stays, and other treatments needed post-accident. |

| Lost Wages | Compensates for income lost if you cannot work due to accident-related injuries. |

| Rehabilitation Costs | Covers physical therapy and other rehabilitation services to aid in recovery. |

| Funeral Expenses | Offers compensation for funeral costs if the accident leads to a fatality. |

| Household Services | Covers expenses for essential services (e.g., cleaning, cooking) if you’re unable to perform them. |

| Childcare Expenses | Provides compensation for childcare if you are unable to care for children due to your injuries. |

Limitations and Exclusions

Most PIP policies have a coverage limit ranging from $2,500 to $250,000, depending on the state and your selected coverage level. Additionally, PIP may not cover certain injuries, such as those that occur outside of vehicle-related incidents. Each insurer has specific exclusions, so reviewing your policy details is essential.

States That Require PIP

Not every state requires Personal Injury Protection. PIP insurance is primarily mandated in no-fault states where drivers must first use their insurance for medical claims before turning to the at-fault party’s insurance. Here are some key states where PIP is either required or optional:

States Requiring PIP Coverage

- Florida

- Hawaii

- Kansas

- Massachusetts

- Michigan

- Minnesota

- New York

- North Dakota

- Utah

States Offering Optional PIP Coverage

Even in states where PIP is not mandatory, adding this coverage can be beneficial, especially if you want immediate medical coverage after an accident. California, Arizona, and Texas are examples of states where PIP is available as an add-on to standard auto insurance.

For more information on PIP requirements in your state, consult the National Association of Insurance Commissioners (NAIC) website.

How to File a PIP Claim

Filing a PIP claim is similar to the process for other insurance claims but involves specific documentation to support the unique benefits of PIP. Here’s a step-by-step guide to filing your PIP claim:

Step 1: Report the Accident to Your Insurance Company

Contact your insurance provider immediately after the accident. Most insurers require that a PIP claim be filed within 30 days, although the timeframe may vary by provider and state.

- Provide details of the accident, such as the time, location, and cause.

- Mention any injuries sustained, no matter how minor, as they may require compensation later.

Step 2: Gather Necessary Documentation

To support your PIP claim, collect the following documents:

- Medical records: Include all diagnoses, treatments, and bills related to injuries from the accident.

- Proof of lost wages: Pay stubs or employer statements can help verify lost income if you miss work.

- Receipts for services: If you incurred additional expenses like childcare or household help, include receipts as proof.

- Police report: Although not always required, a police report can help corroborate the accident’s details.

Step 3: Submit a PIP Claim Form

Complete your insurer’s PIP claim form accurately and provide all required information. Typically, you’ll need to include:

- Personal details

- Policy number

- Accident information

- Details on injuries and incurred expenses

Step 4: Follow Up with Your Insurance Adjuster

After filing the claim, an insurance adjuster may contact you to verify details or request additional documentation. Staying in touch with your adjuster can speed up the process and prevent misunderstandings that could delay your claim.

Maximizing Your PIP Benefits

Maximizing your PIP insurance benefits involves knowing your rights and understanding the policy limits. Here are some tips to ensure you get the most from your PIP coverage:

Understand Your Policy’s Limits

Every PIP policy has a maximum coverage amount, which could vary widely. Ensure you know your policy limits, as well as what expenses count toward that limit, to manage your claim effectively.

Seek Immediate Medical Attention

Promptly seeing a healthcare provider can establish a link between your injuries and the accident. Delays in treatment may lead to complications in proving that your injuries were directly related to the accident, affecting your compensation.

Keep Detailed Records of All Expenses

Keep meticulous records of all accident-related costs, including medical bills, therapy receipts, and any services required while recovering. These records will support your claim and expedite the reimbursement process.

Communicate Clearly with Your Insurance Provider

Insurance companies may have multiple adjusters or representatives working on a single case. Being clear and concise in all communications can help avoid delays and misunderstandings that might impact your claim.

Consider Legal Representation if Needed

If you encounter difficulties with your claim or receive less than expected, consider consulting an attorney specializing in auto insurance claims. Legal representation can sometimes be beneficial if your claim is denied or if you feel your insurer is acting in bad faith.

Conclusion and FAQ

Personal Injury Protection (PIP) is an essential coverage option for individuals seeking prompt compensation for medical expenses and related costs following a car accident. Understanding your PIP benefits, knowing how to file a claim, and following best practices for maximizing your payout can make a significant difference in your recovery and financial stability.

FAQ Insights

What exactly does PIP insurance cover?

PIP insurance typically covers:

- Medical expenses for treatments related to accident injuries.

- Lost wages if injuries prevent you from working.

- Rehabilitation costs for necessary physical therapy.

- Household services and childcare expenses if you’re unable to manage daily responsibilities.

How do I file a PIP claim?

- Report the accident to your insurer immediately.

- Gather documentation such as medical records, proof of lost wages, and receipts for household expenses.

- Complete your insurer’s PIP claim form with accurate and thorough details.

- Follow up with your adjuster to confirm the claim’s progress.

Do all states require PIP insurance?

No, only certain no-fault states require PIP insurance by law, including Florida, Michigan, and New York. In other states, it may be optional but still available.

What should I do if my PIP claim is denied?

If your PIP claim is denied:

- Review your denial letter to understand why the claim was rejected.

- Gather additional documentation to strengthen your case.

- Submit an appeal to your insurance provider or consider legal help.

Personal Injury Protection offers peace of mind and financial security following an accident. By understanding your rights and following a structured approach to filing a claim, you can navigate the complexities of PIP and ensure a smoother path to recovery.