Day trading strategies for forex have gained significant popularity among traders looking to capitalize on short-term price movements in the foreign exchange market. This fast-paced environment offers numerous opportunities, but it also comes with risks that require careful planning and execution. In this comprehensive guide, we’ll explore various day trading strategies, essential tips, and current data to help you navigate the forex market effectively.

Understanding Day Trading in Forex

Day trading involves buying and selling currencies within the same trading day, often holding positions for minutes to hours. Unlike long-term investing, day traders aim to profit from small price fluctuations, making quick decisions based on technical analysis and market trends.

The Appeal of Day Trading Forex

- High Liquidity: The forex market is the most liquid financial market globally, with an average daily trading volume exceeding $6 trillion. This liquidity allows for quick entry and exit from trades.

- 24-Hour Market: Forex trading occurs 24 hours a day, five days a week, providing flexibility for traders to enter the market at their convenience.

- Leverage Opportunities: Forex brokers often offer significant leverage, enabling traders to control larger positions with a smaller amount of capital. However, this increases both potential gains and risks.

Key Day Trading Strategies for Forex

Understanding effective day trading strategies for forex is crucial for success. Here are some widely used strategies that can enhance your trading performance:

Scalping

Scalping is one of the most popular day trading strategies, focusing on making small profits from numerous trades throughout the day. Here’s how to implement it:

How Scalping Works

- Short Holding Period: Traders hold positions for seconds to minutes, aiming for quick profits.

- High Trade Frequency: Scalpers may execute dozens of trades in a single day.

- Tight Spreads: Focus on currency pairs with tight spreads to maximize profitability.

Tips for Successful Scalping

- Use a reliable trading platform with minimal latency.

- Keep an eye on economic news releases that could cause volatility.

- Set strict stop-loss orders to manage risk effectively.

Momentum Trading

Momentum trading involves identifying and capitalizing on trends in the market. Traders look for currency pairs that are moving strongly in one direction and aim to ride that momentum for profit.

How to Identify Momentum

- Technical Indicators: Use indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to identify overbought or oversold conditions.

- Volume Analysis: Higher trading volumes can indicate strong momentum in a specific direction.

Momentum Trading Tips

- Enter trades when momentum indicators signal a strong trend.

- Be prepared to exit positions quickly if the trend reverses.

- Monitor news and events that could impact momentum.

Breakout Trading

Breakout trading is a strategy that aims to profit from significant price movements when a currency pair breaks through a predefined support or resistance level.

Identifying Breakouts

- Support and Resistance Levels: Draw horizontal lines on your charts to identify key levels where prices have historically bounced or reversed.

- Volume Confirmation: Look for increased volume when the price breaks through these levels, indicating strong interest from traders.

Tips for Breakout Trading

- Set entry orders just above resistance levels for long positions or below support levels for short positions.

- Use stop-loss orders to protect against false breakouts.

- Wait for confirmation of the breakout before entering a trade.

Range Trading

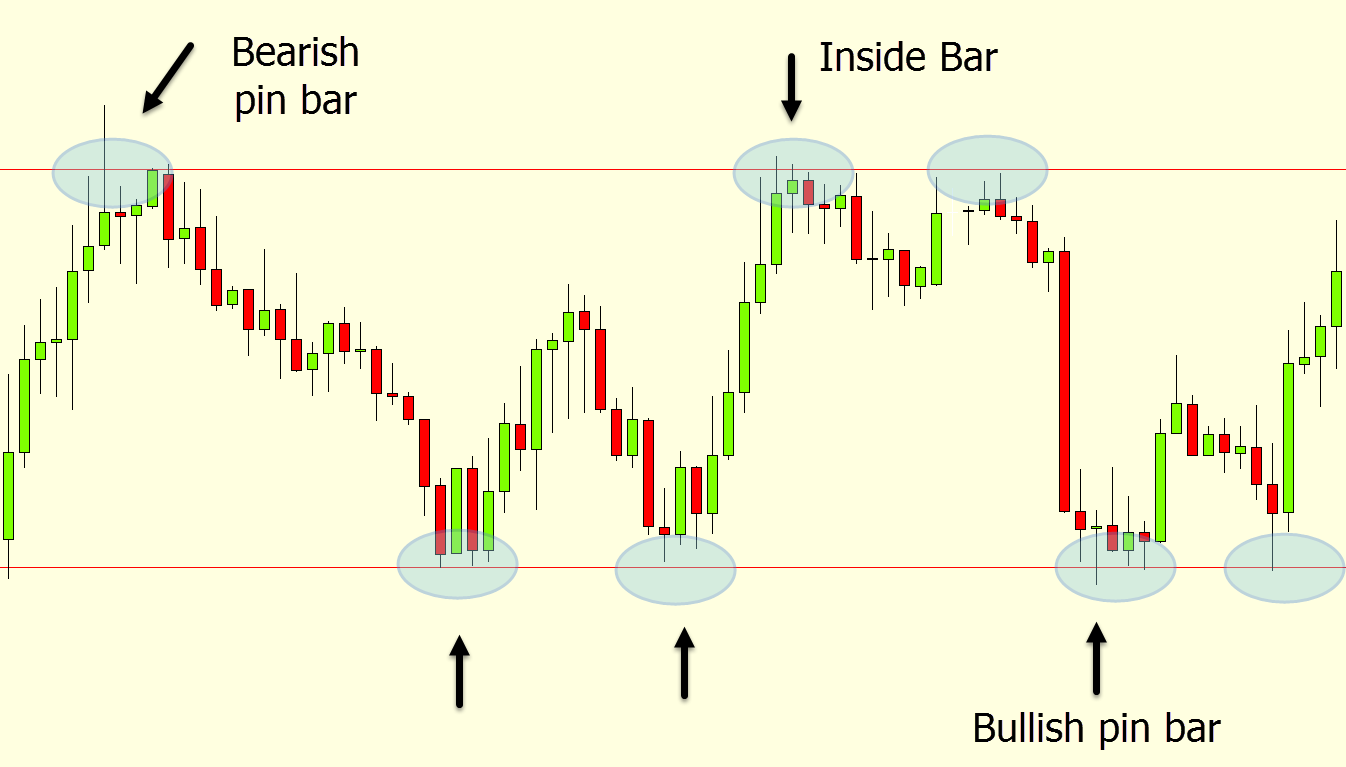

Range trading involves identifying and trading within established price ranges, buying at support levels and selling at resistance levels.

Implementing Range Trading

- Identify Price Ranges: Use historical price data to find ranges where the currency pair has traded frequently.

- Use Oscillators: Indicators like the Stochastic Oscillator can help identify overbought and oversold conditions within the range.

Range Trading Tips

- Avoid range trading during high volatility or news events that could break the range.

- Use tight stop-loss orders to manage risk, as ranges can be broken.

- Be patient and wait for the price to approach support or resistance before entering trades.

News Trading

News trading takes advantage of market volatility caused by economic news releases, geopolitical events, or central bank announcements.

How to Trade News

- Economic Calendar: Keep an eye on economic calendars to track upcoming news events that could impact the forex market.

- Quick Execution: Be prepared to enter trades immediately after news releases, as prices can move rapidly.

News Trading Tips

- Analyze historical price movements after similar news releases to gauge potential impacts.

- Use limit orders to enter trades at specific price levels.

- Be cautious of slippage during high volatility periods.

Risk Management in Day Trading Forex

Effective risk management is crucial for any trading strategy. Here are key principles to help you manage risk while day trading in forex:

Set a Risk-to-Reward Ratio

Before entering a trade, determine your risk-to-reward ratio. A common guideline is to aim for a ratio of at least 1:2, meaning for every $1 you risk, you aim to make at least $2.

Use Stop-Loss Orders

Always use stop-loss orders to limit potential losses. Determine your stop-loss level before entering a trade based on technical analysis and your risk tolerance.

Limit Your Position Size

Avoid over-leveraging your account. A good rule of thumb is to risk no more than 1-2% of your trading capital on a single trade.

Stay Disciplined

Stick to your trading plan and avoid emotional trading decisions. Discipline is essential for long-term success in day trading.

Tools and Resources for Day Traders

Utilizing the right tools and resources can significantly enhance your day trading experience. Here are some recommended tools for forex traders:

Trading Platforms

Choose a reliable trading platform that offers advanced charting tools, technical indicators, and a user-friendly interface. Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Economic Calendars

Economic calendars are essential for keeping track of upcoming news events that could impact the forex market. Websites like Forex Factory provide real-time calendars and news releases.

Technical Analysis Tools

Utilize various technical analysis tools, such as Fibonacci retracement, trend lines, and candlestick patterns, to enhance your trading strategies.

Community Forums and Social Media

Engage with other traders through online forums or social media groups. Sharing experiences and strategies can provide valuable insights and support.

Staying Informed and Adapting Your Strategy

The forex market is constantly evolving, and staying informed is crucial for success. Here are some tips for adapting your day trading strategies:

Continuous Learning

Commit to continuous learning by reading books, taking online courses, or attending webinars. This will help you stay updated on the latest strategies and market trends.

Analyze Your Trades

Regularly review your trades to identify what works and what doesn’t. Keep a trading journal to track your successes and mistakes, allowing you to refine your strategies.

Be Flexible

Market conditions can change rapidly. Be prepared to adjust your strategies based on new information, market trends, or economic developments.

Network with Other Traders

Networking with other traders can provide valuable insights and different perspectives on the market. Consider joining trading groups or attending industry events.

Conclusion

Day trading strategies for forex can be rewarding, but they require a solid understanding of the market, effective strategies, and disciplined risk management. By exploring various strategies such as scalping, momentum trading, breakout trading, range trading, and news trading, you can find the approach that suits your trading style. Remember to stay informed, adapt to market conditions, and continuously learn to improve your trading skills.