In the fast-paced world of forex trading, understanding how to analyze the market is crucial for success. Forex market analysis helps traders make informed decisions by evaluating various economic, political, and technical factors that influence currency prices. This article will explore the different types of market analysis, their significance, and how to apply them effectively to enhance your trading strategies.

Understanding Forex Market Analysis

Definition and Purpose

Forex market analysis refers to the process of evaluating various factors that affect currency exchange rates. The primary purpose is to identify trends, potential reversals, and opportunities for profit.

- Types of Analysis: Traders typically use three main types of analysis: fundamental, technical, and sentiment analysis.

- Goal: The ultimate goal is to make informed trading decisions that maximize returns while minimizing risks.

Importance of Market Analysis in Forex Trading

Effective market analysis is vital for several reasons:

- Informed Decision-Making: Analyzing market conditions helps traders understand where to enter and exit trades.

- Risk Management: Knowledge of market trends and potential reversals can help in setting stop-loss orders effectively.

- Strategy Development: Market analysis provides the foundation for developing and refining trading strategies.

Types of Forex Market Analysis

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, news events, and geopolitical factors that affect currency values.

Economic Indicators

Key economic indicators include:

- Gross Domestic Product (GDP): Measures the economic performance of a country. A rising GDP generally strengthens a currency.

- Inflation Rates: High inflation can weaken a currency, while moderate inflation may support it.

- Unemployment Rates: Low unemployment rates usually indicate a healthy economy, leading to currency appreciation.

News and Events

Major news releases can significantly impact forex markets:

- Central Bank Decisions: Interest rate changes by central banks can cause immediate fluctuations in currency values.

- Geopolitical Events: Events like elections, trade agreements, and conflicts can influence market sentiment.

Market Sentiment

Market sentiment reflects traders’ overall attitude toward a currency, often influenced by news and economic data.

- Surveys and Indices: Sentiment indicators, such as the Consumer Confidence Index (CCI) and Purchasing Managers’ Index (PMI), provide insights into market mood.

Technical Analysis

Technical analysis focuses on historical price data to identify patterns and trends that can predict future price movements.

Chart Patterns

Traders analyze various chart patterns to forecast price movements:

- Head and Shoulders: Indicates potential reversals; the price may change direction after forming this pattern.

- Double Tops and Bottoms: Suggests that a currency pair has reached a significant resistance or support level.

Technical Indicators

Numerous indicators help traders analyze price movements:

- Moving Averages (MA): Helps smooth out price data to identify trends over time. The 50-day and 200-day moving averages are commonly used.

- Relative Strength Index (RSI): Measures the speed and change of price movements. An RSI above 70 indicates overbought conditions, while below 30 suggests oversold.

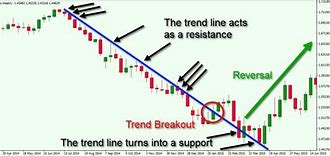

Support and Resistance Levels

Support and resistance levels are crucial in technical analysis.

- Support Level: A price level where buying interest is strong enough to prevent further decline.

- Resistance Level: A price level where selling interest is strong enough to prevent further increases.

Sentiment Analysis

Sentiment analysis assesses the mood of the market and how it affects trading decisions.

Understanding Market Sentiment

Market sentiment can be bullish (positive) or bearish (negative):

- Bullish Sentiment: Indicates traders expect prices to rise, leading to increased buying activity.

- Bearish Sentiment: Indicates traders expect prices to fall, leading to increased selling activity.

Tools for Sentiment Analysis

Various tools and resources help gauge market sentiment:

- Commitment of Traders (COT) Reports: Provide insights into the positions of various market participants, including commercial and non-commercial traders.

- Social Media and News: Monitoring social media platforms and financial news can offer insights into trader sentiment and expectations.

Integrating Different Types of Analysis

Combining Fundamental and Technical Analysis

To maximize trading effectiveness, many traders integrate both fundamental and technical analysis.

Fundamental Analysis for Long-Term Trends

Fundamental analysis is more suited for long-term trading strategies. Understanding economic indicators and geopolitical events can help identify potential long-term trends.

- Example: If a country’s GDP is consistently growing, its currency is likely to appreciate over time.

Technical Analysis for Entry and Exit Points

Technical analysis is used to identify optimal entry and exit points in line with fundamental trends.

- Example: A trader may identify a bullish trend supported by strong economic data and use technical indicators to time their entry.

Sentiment Analysis as a Complement

Integrating sentiment analysis can enhance trading decisions:

- Confirmation of Trends: If both fundamental and technical analyses indicate a bullish trend, but sentiment is bearish, traders might approach with caution.

- Identifying Contrarian Opportunities: When sentiment is overly bullish or bearish, it may indicate an impending reversal.

Practical Steps for Conducting Forex Market Analysis

Setting Up Your Trading Plan

A well-defined trading plan incorporates different types of analysis.

Define Your Goals

Identify your trading objectives, such as risk tolerance, profit targets, and trading style.

- Long-Term vs. Short-Term Goals: Understanding your goals will shape your analysis approach.

Choose Your Analysis Tools

Select the tools and platforms you will use for market analysis.

- Charting Software: Platforms like MetaTrader 4 or TradingView offer advanced charting capabilities.

Regularly Monitor Economic Indicators

Stay informed about key economic indicators and their impact on the forex market.

Use an Economic Calendar

An economic calendar provides a schedule of upcoming economic events and data releases.

- Stay Updated: Regularly check the calendar to prepare for potential market movements.

Analyze Market Sentiment

Incorporate sentiment analysis into your trading routine.

Review COT Reports

Regularly review Commitment of Traders (COT) reports to gauge the positioning of major market participants.

- Identify Trends: Look for shifts in positioning that could indicate changes in market sentiment.

Keep a Trading Journal

Maintaining a trading journal helps track your analysis and trading performance.

Document Your Trades

Record each trade, including your analysis, entry and exit points, and outcomes.

- Learning Tool: Regularly review your journal to identify strengths and areas for improvement.

Common Challenges in Forex Market Analysis

Information Overload

The abundance of data can be overwhelming for traders.

Focus on Relevant Information

Prioritize the most impactful indicators and news events that align with your trading strategy.

- Avoid Distraction: Narrowing your focus can help prevent analysis paralysis.

Emotional Decision-Making

Emotions can cloud judgment and lead to poor trading decisions.

Stick to Your Plan

Following your trading plan helps mitigate emotional trading decisions.

- Discipline is Key: Remain disciplined and avoid impulsive reactions to market fluctuations.

Market Volatility

The forex market can be highly volatile, leading to unexpected price movements.

Use Stop-Loss Orders

Implementing stop-loss orders can protect your capital during high volatility.

- Risk Management: Effective risk management strategies are essential to navigate market fluctuations.

Conclusion: Mastering Forex Market Analysis

Forex market analysis is a fundamental skill that every trader must develop to succeed in the forex market. By understanding and applying fundamental, technical, and sentiment analysis, traders can make informed decisions and enhance their trading strategies. Regularly monitoring economic indicators, practicing disciplined trading, and utilizing a trading journal can further improve your trading performance.