In the world of forex trading, understanding market dynamics is crucial for success. Forex price action trading is a popular method that focuses on the price movements of currency pairs, allowing traders to make informed decisions based solely on price data without relying heavily on indicators. This article will delve into the principles of price action trading, its benefits, strategies, and how to implement it effectively in your trading routine.

Understanding Price Action Trading

What is Price Action Trading?

Price action trading is a strategy that analyzes historical and current price movements to predict future price trends. Traders using this method rely on chart patterns, support and resistance levels, and price behavior to make trading decisions.

- Core Principle: The fundamental belief behind price action trading is that price reflects all relevant information and sentiment in the market.

- Simplicity: It allows traders to keep their charts clean and focused, avoiding the clutter of numerous technical indicators.

The Importance of Price Action in Forex

Price action is vital in forex trading for several reasons:

- Direct Market Insight: By focusing on price movements, traders can gain insights into market sentiment and potential reversals.

- Flexibility: Price action trading can be applied across various time frames, making it suitable for day traders, swing traders, and long-term investors alike.

Key Concepts in Forex Price Action Trading

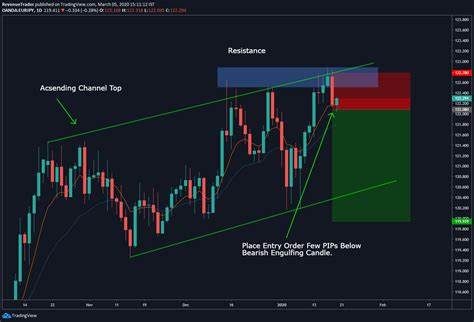

Support and Resistance

Support and resistance levels are critical concepts in price action trading.

Support Levels

Support levels are price points where buying interest is strong enough to prevent the price from falling further.

- Identification: These levels can be identified by looking at historical price data where prices have previously bounced back.

Resistance Levels

Resistance levels are the opposite of support; they are price points where selling interest prevents the price from rising.

- Trading Strategy: Traders often look for opportunities to sell near resistance levels and buy near support levels.

Candlestick Patterns

Candlestick patterns are essential in understanding price action.

Basic Candlestick Patterns

Traders use various candlestick patterns to gauge market sentiment and potential reversals:

- Doji: A doji candlestick indicates indecision in the market and can signal potential reversals.

- Engulfing Pattern: A bullish engulfing pattern occurs when a smaller bearish candle is followed by a larger bullish candle, suggesting a potential upward trend.

Advanced Candlestick Patterns

More complex patterns provide deeper insights:

- Hammer: A hammer candlestick appears after a downtrend and may indicate a reversal.

- Shooting Star: This pattern appears at the top of an uptrend and suggests a potential bearish reversal.

Trend Lines

Trend lines are simple yet powerful tools in price action trading.

1. Drawing Trend Lines

Trend lines are drawn by connecting two or more price points, showing the overall direction of the market.

- Uptrend: In an uptrend, the line connects the lows, indicating increasing buying pressure.

- Downtrend: In a downtrend, the line connects the highs, indicating increasing selling pressure.

Breakouts and Reversals

Trend lines can help identify potential breakouts or reversals:

- Breakouts: When the price breaks through a trend line, it may indicate a continuation of the trend.

- Reversals: A reversal occurs when the price fails to maintain momentum in the direction of the trend line.

Developing a Price Action Trading Strategy

Choosing a Trading Time Frame

Selecting the right time frame is essential for successful price action trading.

Day Trading

Day traders often use shorter time frames (5-minute to 15-minute charts) to capture quick price movements.

- Fast-Paced Environment: This approach requires quick decision-making and discipline.

Swing Trading

Swing traders focus on medium time frames (1-hour to daily charts) to capture larger price movements.

- Holding Period: Positions are typically held for several days to weeks, allowing for more analysis.

Long-Term Trading

Long-term traders use daily or weekly charts, focusing on significant price trends over months or years.

- Less Frequent Trading: This approach allows for more patience and analysis of fundamental factors.

Implementing Risk Management

Effective risk management is crucial in forex trading to protect your capital.

Setting Stop-Loss Orders

A stop-loss order is a predetermined level where a trader will exit a losing position to limit losses.

- Position Size: Determine your position size based on your risk tolerance and stop-loss levels.

Risk-Reward Ratio

Maintain a favorable risk-reward ratio by ensuring that potential profits outweigh potential losses.

- Common Ratios: A 1:2 or 1:3 ratio is often recommended, meaning you aim to gain two or three times the amount you risk.

Analyzing Market Sentiment

Understanding market sentiment is vital in price action trading.

News and Events

Stay informed about economic news and events that can influence market sentiment and price movements.

- Event Tracking: Monitor major announcements such as interest rate changes, employment reports, and geopolitical events.

Market Psychology

Be aware of how trader psychology can impact price action.

- Emotional Reactions: Traders may react emotionally to market movements, creating opportunities for price action traders.

Common Challenges in Price Action Trading

Emotional Trading

Trading based on emotions can lead to poor decision-making.

- Discipline: Stick to your trading plan and avoid impulsive reactions to market fluctuations.

Misinterpretation of Patterns

Candlestick patterns and price action can be misinterpreted.

- Practice: Regularly practice analyzing charts to improve your ability to identify genuine signals.

Market Noise

In volatile markets, price movements may be erratic, making it challenging to discern true trends.

- Patience: Wait for clear signals and avoid trading during high volatility unless you are experienced.

Tools and Resources for Price Action Trading

Charting Software

Using reliable charting software is essential for effective price action trading.

MetaTrader 4 (MT4)

MetaTrader 4 is a widely-used platform that offers comprehensive charting tools for price action analysis.

- User-Friendly Interface: Ideal for both beginners and experienced traders.

TradingView

TradingView provides advanced charting capabilities and community insights.

- Collaboration: Traders can share ideas and strategies, enhancing the learning experience.

Economic Calendars

An economic calendar helps traders stay informed about upcoming economic events that may impact currency prices.

- Event Tracking: Monitor key releases to anticipate potential market movements.

Conclusion: Mastering Forex Price Action Trading

Forex price action trading is a powerful approach that empowers traders to make decisions based on price movements rather than relying solely on indicators. By understanding key concepts such as support and resistance, candlestick patterns, and market sentiment, traders can enhance their trading strategies and improve their decision-making processes. While challenges exist, effective risk management and discipline can lead to successful trading outcomes.