bbc.towzdog.com – Understanding how to read forex charts is fundamental for any trader looking to navigate the foreign exchange market effectively. Forex charts provide a visual representation of price movements over time, allowing traders to analyze trends, identify opportunities, and make informed trading decisions. In this article, we’ll explore the different types of forex charts, how to interpret them, and tips for maximizing your trading success.

What Are Forex Charts?

Introduction to Forex Charts

Forex charts are graphical representations of currency pair price movements over a specific period. They display the historical performance of a currency pair and can help traders analyze market trends and patterns.

Why Forex Charts Matter

- Trend Analysis: Charts allow traders to identify upward, downward, or sideways trends, which can guide their trading strategies.

- Entry and Exit Points: By observing price movements, traders can determine optimal points for entering or exiting trades.

- Risk Management: Understanding chart patterns helps in setting stop-loss and take-profit levels, which are crucial for managing risk.

Types of Forex Charts

Line Charts

What is a Line Chart?

A line chart is the simplest form of forex chart, connecting closing prices over a specific time period with a continuous line.

When to Use Line Charts

- Trend Overview: Line charts provide a clear view of the overall trend.

- Basic Analysis: They are ideal for beginners who are just starting to understand price movements.

Bar Charts

Understanding Bar Charts

A bar chart provides more detailed information than a line chart. Each bar represents the price movement for a specific time period, displaying the open, high, low, and close (OHLC) prices.

Components of a Bar Chart

- Open Price: The price at which the currency pair opened during the time frame.

- High Price: The highest price reached during the time frame.

- Low Price: The lowest price during the time frame.

- Close Price: The price at which the currency pair closed.

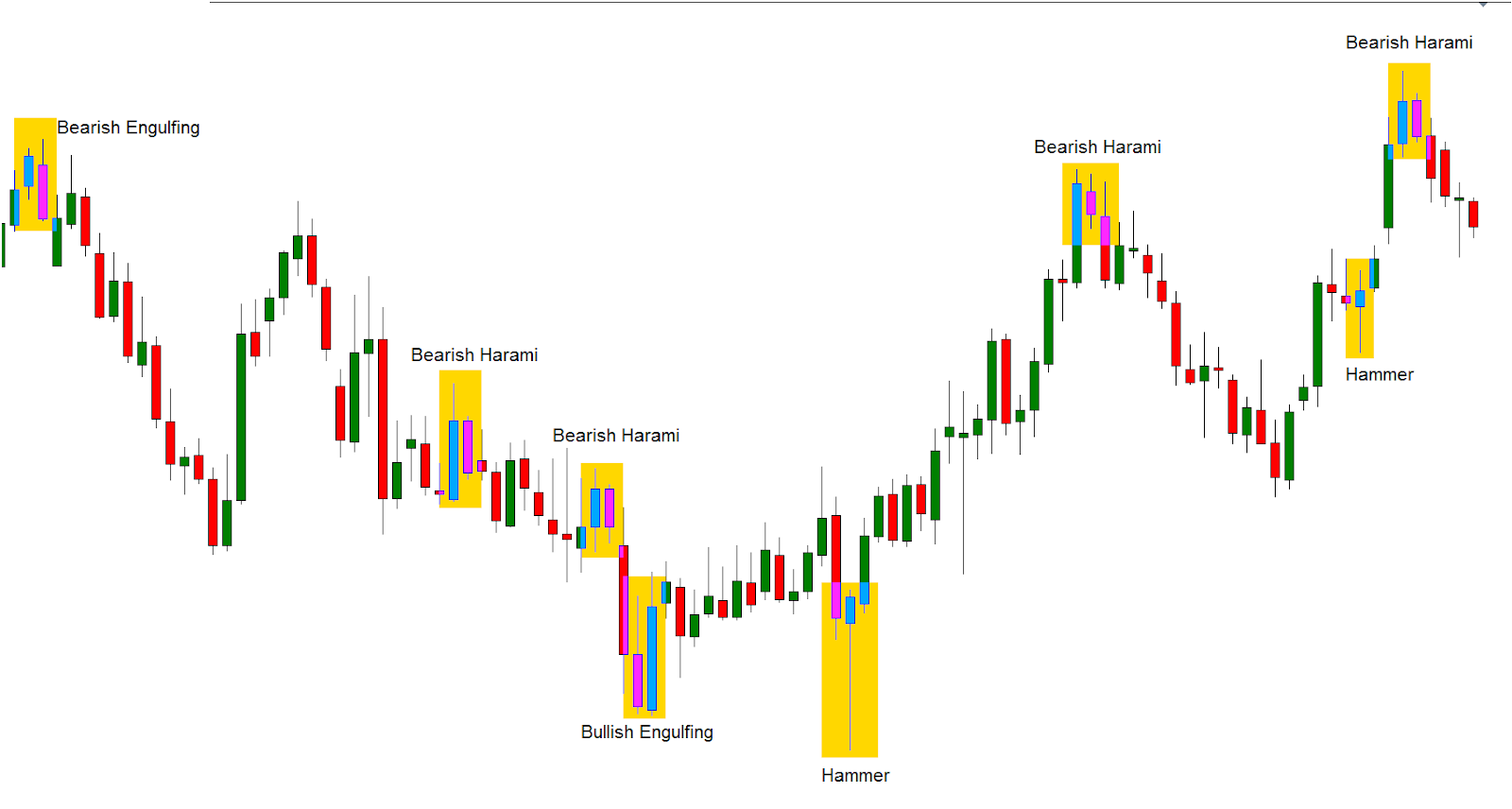

Candlestick Charts

What are Candlestick Charts?

Candlestick charts are similar to bar charts but provide a more visual representation of price movements. Each candlestick represents the open, high, low, and close prices for a specific time period.

Key Features of Candlestick Charts

- Body: The thick part of the candlestick shows the range between the open and close prices.

- Wicks: The thin lines above and below the body represent the high and low prices during that period.

- Color: A green or white body indicates a bullish movement (close price higher than open), while a red or black body indicates a bearish movement (close price lower than open).

Renko Charts

Understanding Renko Charts

Renko charts focus purely on price movement and disregard time. They use “bricks” to represent price changes, filtering out minor fluctuations to provide a clearer trend view.

When to Use Renko Charts

- Trend Following: Ideal for traders focusing on long-term trends without the noise of minor price changes.

- Simplified Analysis: Helps traders to focus solely on significant price movements.

How to Read Forex Charts

Time Frames

Understanding Time Frames

Forex charts can be viewed in various time frames, ranging from one minute (M1) to daily (D1) or even weekly (W1) charts. The chosen time frame significantly impacts your analysis.

Choosing the Right Time Frame

- Short-Term Trading: Use shorter time frames (M1 to M15) for day trading and scalping strategies.

- Long-Term Trading: Longer time frames (H1 to D1) are better for swing trading and position trading strategies.

Identifying Trends

Types of Trends

- Uptrend: Characterized by higher highs and higher lows. Look for upward sloping lines connecting the lows.

- Downtrend: Defined by lower highs and lower lows. Look for downward sloping lines connecting the highs.

- Sideways Trend: When prices move within a range without clear direction.

Tools for Identifying Trends

- Trend Lines: Drawn by connecting consecutive lows in an uptrend or consecutive highs in a downtrend.

- Moving Averages: Help smooth out price data and indicate the overall trend direction.

Support and Resistance Levels

What are Support and Resistance Levels?

- Support Level: A price level where buying interest is strong enough to overcome selling pressure, preventing the price from falling further.

- Resistance Level: A price level where selling interest is strong enough to overcome buying pressure, preventing the price from rising further.

How to Identify Support and Resistance

- Historical Data: Look for previous highs and lows where the price has reversed.

- Horizontal Lines: Draw horizontal lines at significant price levels to visualize potential support and resistance.

Chart Patterns

Common Chart Patterns

- Head and Shoulders: Indicates a reversal pattern and can signal the end of an uptrend or downtrend.

- Double Tops and Bottoms: Indicate potential reversals, where a double top signals a bearish reversal and a double bottom signals a bullish reversal.

- Triangles: Can be ascending, descending, or symmetrical, indicating potential continuation or reversal of trends.

How to Trade Chart Patterns

- Entry Points: Enter trades when the price breaks out of the pattern.

- Stop-Loss Levels: Place stop-loss orders just outside the pattern to manage risk.

Using Technical Indicators

What are Technical Indicators?

Technical indicators are mathematical calculations based on historical price and volume data. They help traders analyze price trends and forecast future movements.

Popular Technical Indicators

- Moving Averages: Help identify the direction of the trend.

- Relative Strength Index (RSI): Measures overbought or oversold conditions.

- Bollinger Bands: Indicate volatility and potential price reversals.

Tips for Reading Forex Charts Effectively

Practice with a Demo Account

Using a demo trading account can help you practice reading forex charts without risking real money. Familiarize yourself with different chart types and indicators.

Stay Informed About Economic News

Economic events can significantly impact currency prices. Stay updated with an economic calendar to anticipate market movements.

Combine Different Analysis Techniques

Use a combination of technical and fundamental analysis to enhance your trading strategies. Understanding market sentiment alongside chart patterns can improve decision-making.

Keep a Trading Journal

Document your trades, including the reasons for entering and exiting positions. Analyzing past trades can help you refine your chart-reading skills and develop your trading strategy.

Conclusion

Learning how to read forex charts is a critical skill for any trader looking to succeed in the forex market. By understanding different chart types, recognizing trends, and identifying support and resistance levels, you can enhance your trading strategies and improve your decision-making.

For further information and resources on forex trading, visit Investopedia, where you can find in-depth articles and guides on various trading topics.

Embark on your trading journey with confidence, armed with the knowledge to read forex charts effectively. Happy trading!